Mileage Tracker | Try Our Automatic Mileage Log | Hurdlr

Stop keeping a manual mileage log! Hurdlr automatically tracks your mileage for you. Start maximizing your profit, try our mileage tracker today.

- Reviews: 4K

Hurdlr

Unlimited Auto Mileage Tracking and Effortless FinancesLog In

Best Accounting Software for You | For Owners | Hurdlr

Hurdlr is the best accounting software option for business owners. Simple, powerful and fast, but without all the accounting complexity. Get started today.

- Reviews: 12.8K

Hurdlr University

Detailed features, pricing, cancellation steps, and refund policy.7 articles

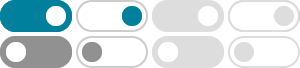

What are my Mileage Tracking Options? | Hurdlr University

The automatic mileage tracker records all your drives, with auto-start and stop detection. All of the details about your drives are automatically recorded including the date, start/end time, …

The Best Business Expense Tracker | Get Started Today | Hurdlr

Automatically track your expenses with Hurdlr's easy to use business expense tracker app. Download today, and never lose track of your expenses again!

- Reviews: 12.8K

Hurdlr for Accountants

Hurdlr for Accountants makes it dead simple for you to administer accounts for your clients. Hurdlr automatically tracks all of their mileage, expenses, income streams, and tax deductions in real …

- Reviews: 12.8K

How do I track personal mileage (medical, charity, etc)?

While Hurdlr is meant to track your business finances and deductions, you can also use it to help track personal itemized deductions (like medical mileage and charity mileage).

What data does the tax filing integration get from Hurdlr?

The tax filing integration does not automatically pull your business income, so you will need to manually input it in the tax filing software. You can get your business income total per …

Tax Deduction Information For Businesses | Hurdlr

TAX IRS Tax Record Keeping Requirements Having good records can help you support your revenues and expenses during a tax or financial statement audit. Here's what you need to know.